When you consider retiring outside the US, you must take into consideration the financial implications of the move. You will want to know if there are medical facilities in the area, whether there are specialists in the area, and how long does it take to get a prescription filled. It is important to find out if there are any taxes. To determine how your existing health insurance plan would change in a new location, you should take a look at it before making a decision.

Health insurance

Retiring outside the U.S. can pose several challenges, including lack of health care in rural areas and costly medical bills. Medicare doesn't cover expatriates living in another country. Therefore, there are three main options to pay for medical care. These include purchasing a local insurance policy or investing in international healthcare insurance. Here are some helpful tips to help guide you in making the right choice regarding international medical care.

Planning ahead

Plan ahead before you consider retiring abroad. You should consider your financial situation, cultural background, and distance from family members and friends. You can choose to work full-time, part-time or both. To see if the country's culture and economy appeal to you, go there. The U.S. State Department provides a detailed guide for retiring abroad. You can then decide if the country is best for you. After you have decided on a destination, make sure to research the country's economic and political stability.

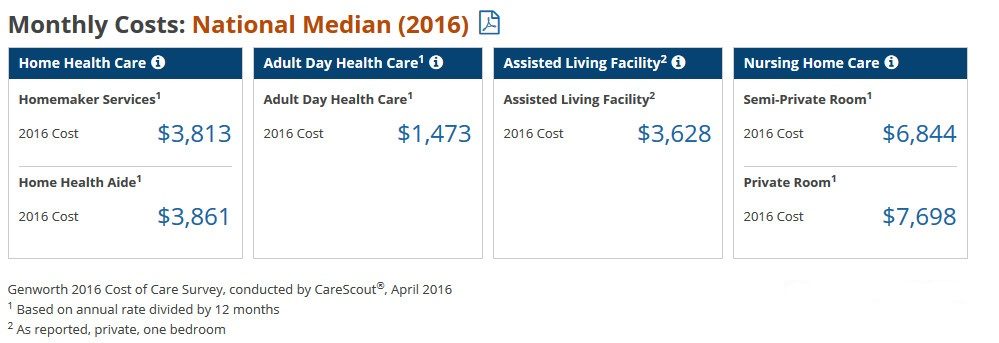

Costs

If you're considering retirement outside the U.S., you must know about certain expenses. For example, Medicare does not cover retirees outside the U.S., so you'll need a foreign health insurance plan. Depending on your personal circumstances, you may be able get a plan that covers several countries at a higher cost than a domestic policy. If the country where you are moving has low healthcare costs, you may be able skip insurance altogether.

Taxes

If you are a US citizen, it is possible to choose to withdraw from the United States and not pay any taxes on your income worldwide. The IRS sets certain thresholds for global income. For example, $12,000 per person, $400 in self-employment income. You will have to file a federal Income Tax Return every year. A conversion must be made to U.S. currency of all assets and foreign income.

Places to retire

Although it may seem risky, you don't need to leave the US to retire. There are many places that offer retirement options that don't require you to be fluent in another language or have a completely new lifestyle. You can even have dinner with American expatriates. In return, you'll have fewer distractions and high living costs. You'll be closer to nature, and have a more affordable lifestyle.